Budget 2023 Expectations: Shorter holding period for non-equity funds, hike in equity LTCG limit to Rs 2 lakh

capital gain tax: Investment limit capped at Rs 10 crore for capital gains account scheme from FY2023-24 - The Economic Times

Union Budget 2023: From Changes In New Tax Regime To Capital Gains And More, How Budget 2023 Affects Personal Finance - Forbes India Blogs

Gains en capital deverrouiller les gains en capital avec des reports de perte d impot - FasterCapital

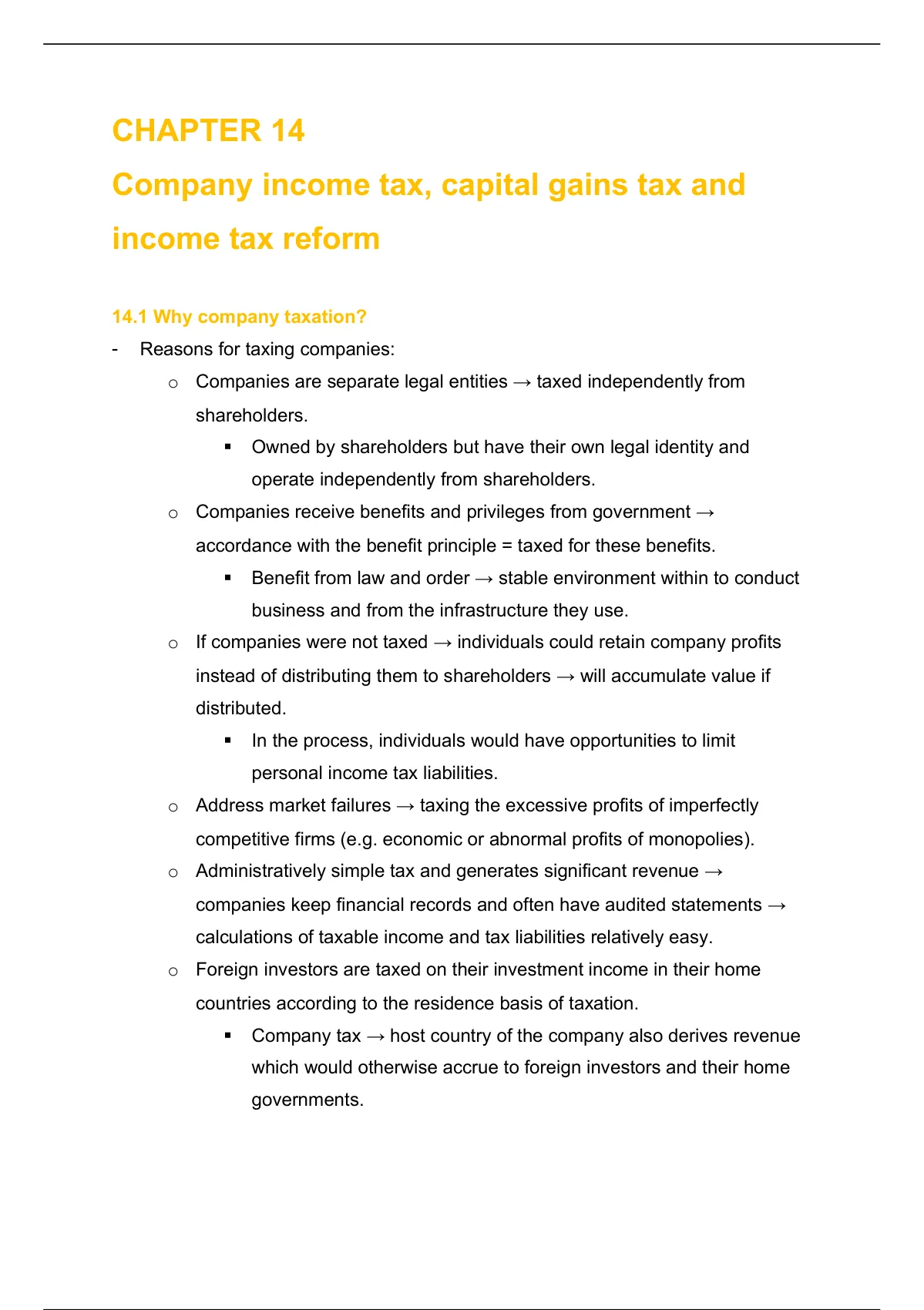

Summary Chapter 14 - Company income tax, capital gains tax and income tax reform - EKN310 - Stuvia FR