New 10pc tax: What Malaysians need to know when buying products online below RM500 from overseas | Malay Mail

Shopee Begins Notifying Users On 10% LVG Sales Tax On Overseas Purchases Below RM500 In 2024 – Pokde.Net

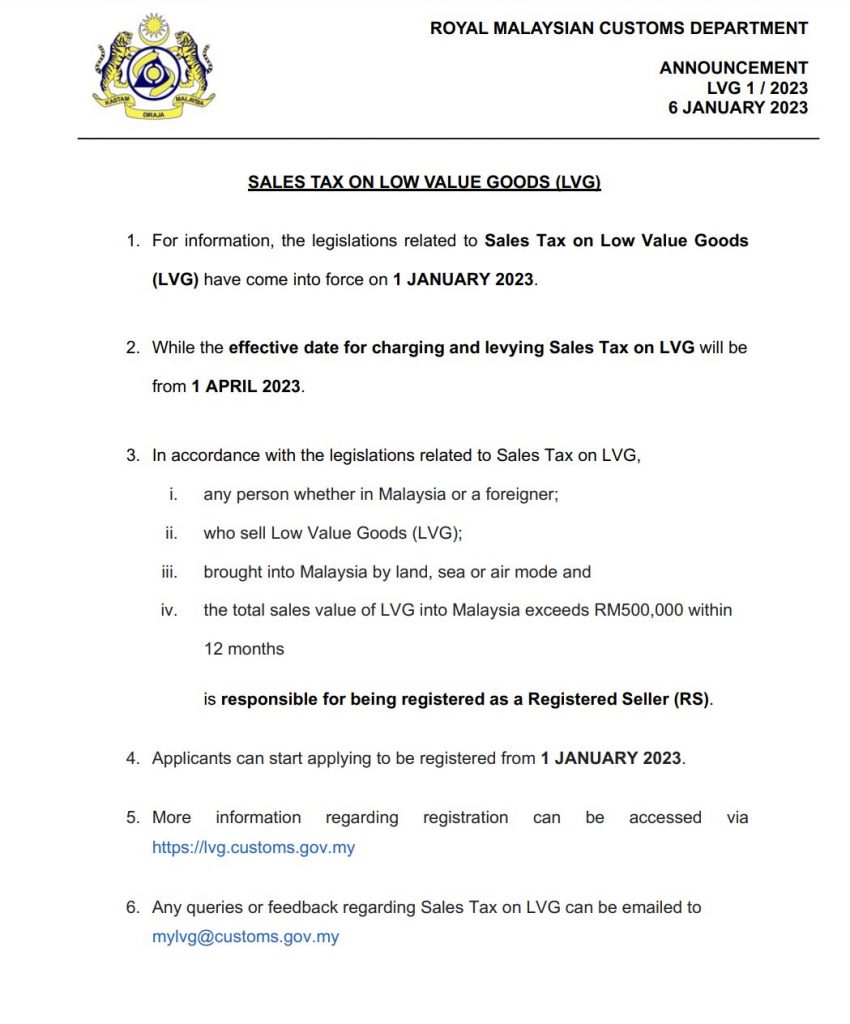

10% tax for imported online shopping goods worth below RM500 from April 2023. Here's what you need to know - SoyaCincau